Analyze S&P Composite 1500 data with AI

Sourcetable's AI is the smartest way to analyze market data. Built for Financial Analysts, Traders & Portfolio Managers, it's your AI-native Bloomberg-alternative.

Our Impact

1,500

U.S. Companies

$52T

Total Market Cap

90%

Time Savings vs Excel

5 Min

Complete Analysis Time

Why Choose Sourcetable for S&P Composite 1500 Analysis?

Combine the power of Excel with advanced AI to analyze the broad U.S. market like never before

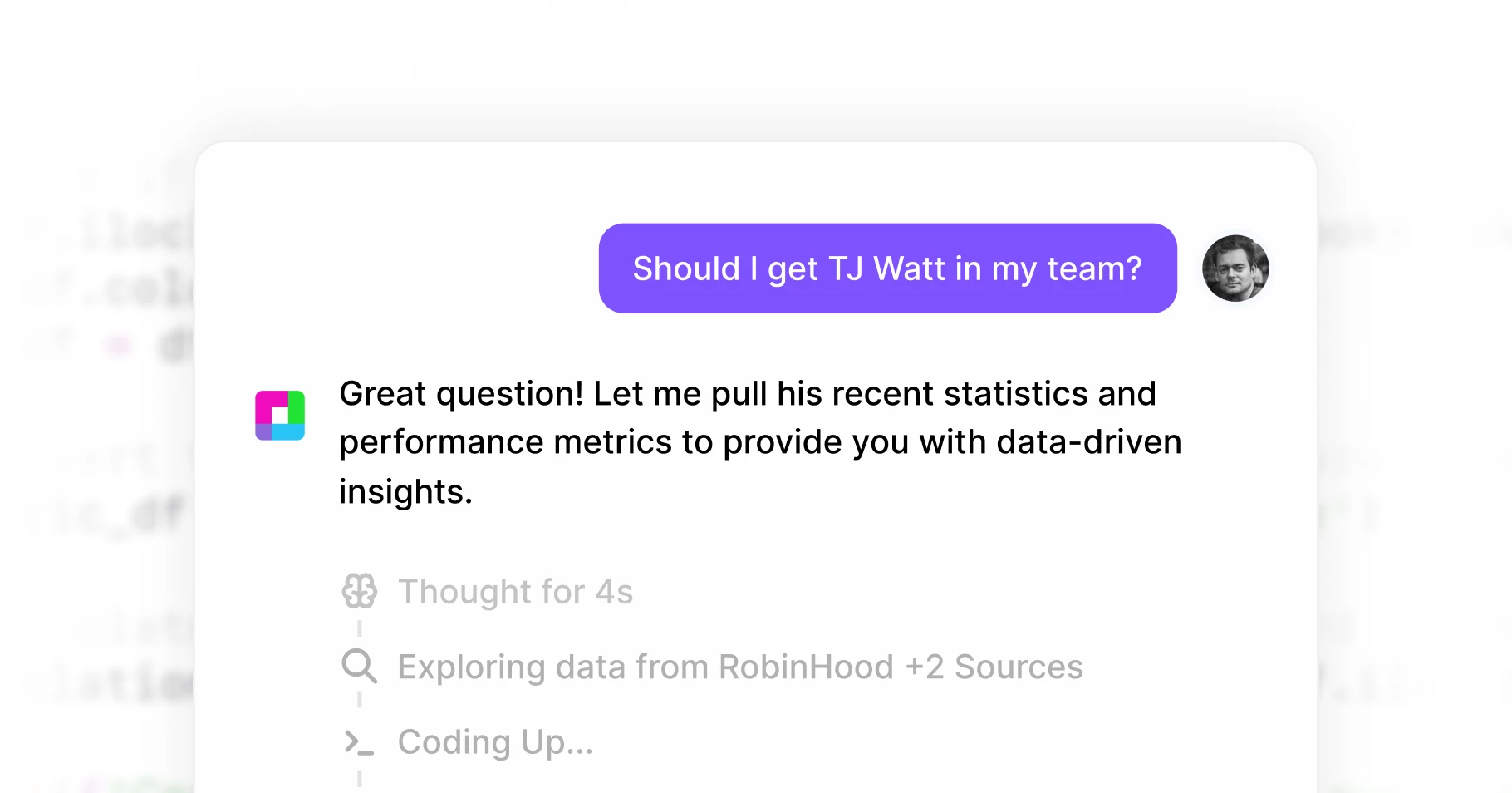

AI-Powered Analysis

Ask questions in plain English: "Which sectors are overweight in the S&P Composite 1500?" Get instant answers with automated calculations and visual insights.

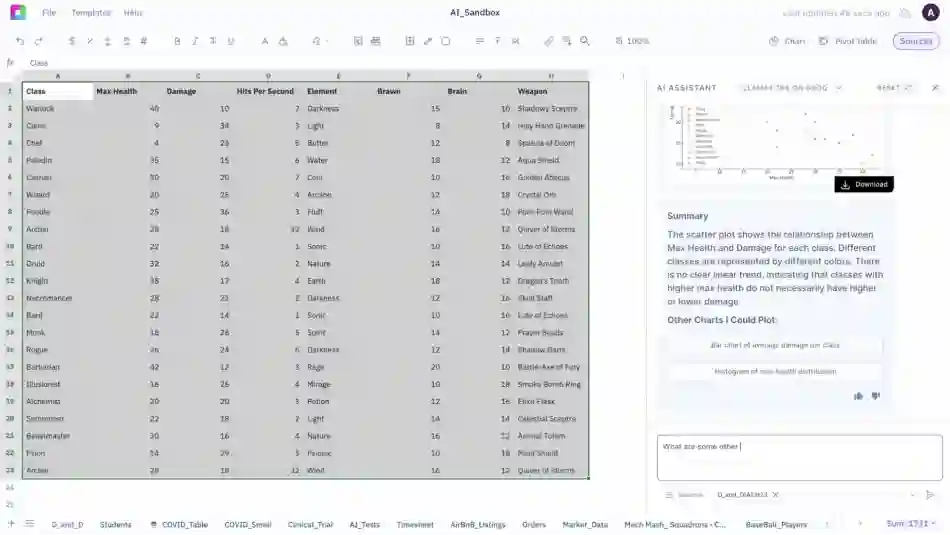

S&P Composite 1500 Data Analysis

Import and analyze S&P Composite 1500 data. Track index performance, constituent weights, sector allocations, and market cap distribution with comprehensive historical data covering large, mid, and small-cap U.S. equities.

Instant Insights

Generate sector comparisons, risk assessments, and performance rankings in seconds. No more manual data entry or complex formula building.

Advanced Visualizations

Create professional charts, heat maps, and dashboards automatically. Export presentation-ready reports for clients or stakeholders.

Smart Screening

Filter S&P Composite 1500 constituents by any criteria: market cap tiers, sector exposure, quality factors, and valuation metrics across the entire U.S. market spectrum.

Risk Analysis

Calculate portfolio risk, correlation matrices, and volatility measures across S&P Composite 1500 holdings with enterprise-grade accuracy.

Sourcetable tools for Stock Analysis

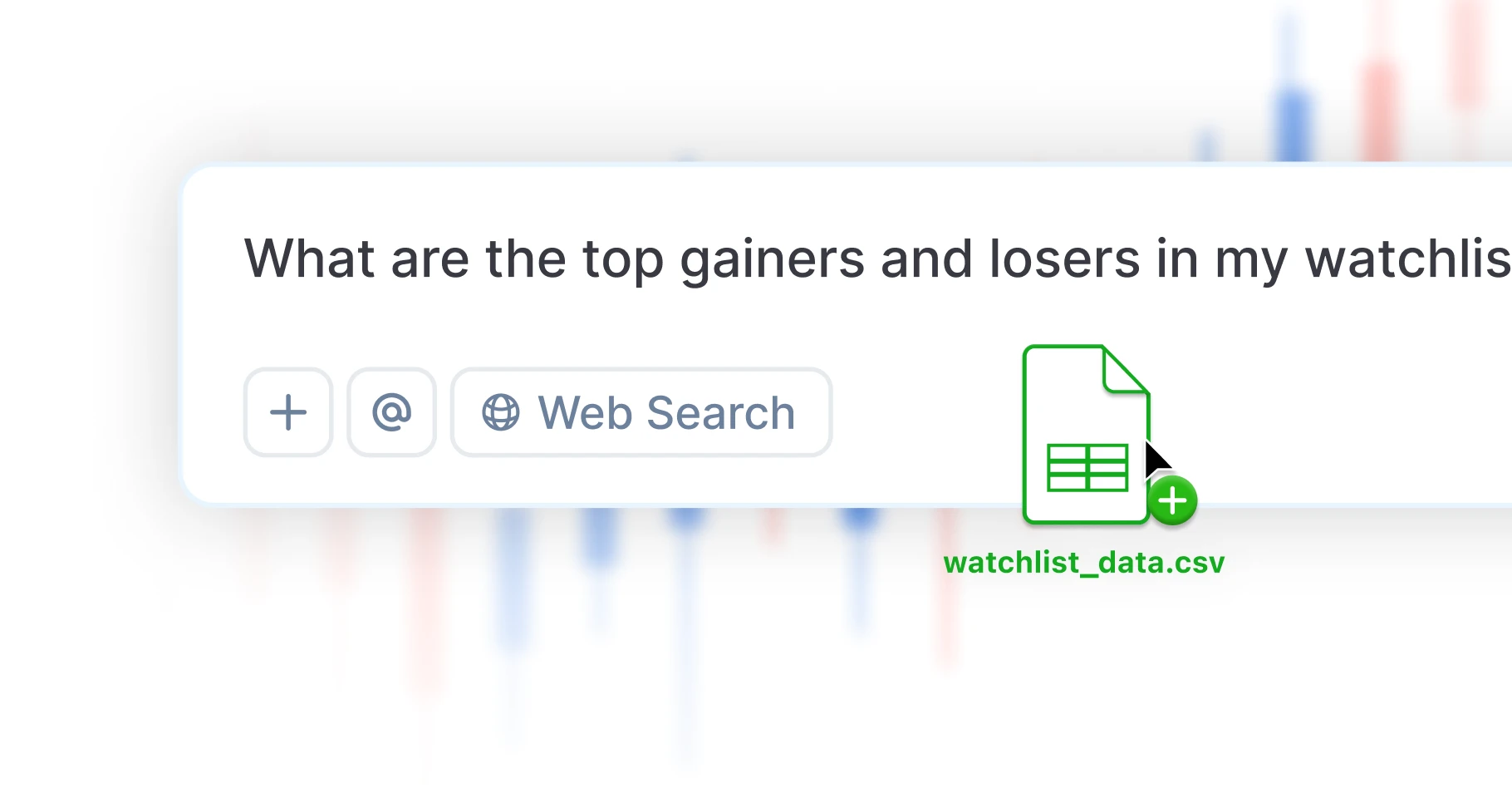

Whether you're tracking stocks or exploring new ideas, Sourcetable brings everything together, market data, your own files, and even insights from across the web.

Yahoo Finance

Access live market data, historical prices, and key metrics directly from Yahoo Finance. All without leaving your spreadsheet.

Financial Tools

Analyze fundamentals, technicals, sentiment, and more using Sourcetable's rich library of built-in AI finance tools.

CSV/XLSX Analysis

Import your own spreadsheets and get instant insights using formulas, visualizations, and AI-powered analysis tools.

Market Analysis Tools

Plan, research, and analyze markets inside Sourcetable with macro trading models, portfolio balancing, and advanced stock analysis. making complex strategies easier to design, test, and compare.

Code with AI

Run advanced financial analysis and research with natural language and Python-powered models.

Stay Connected

Connect brokerages, exchanges, data providers, and databases into one workflow via Superagents.

Execute Trades

Place trades through connected brokerages and platforms, alongside research and modeling.

Frequently Asked Questions

If your question is not covered here, you can contact our team.

Contact UsWhat tools does Sourcetable offer for index analysis?

What data sources does Sourcetable support?

How do I import S&P Composite 1500 data into Sourcetable?

What analysis can I do with S&P Composite 1500 data?

How much does Sourcetable cost?

Can I create charts and visualizations?

How do I analyze S&P Composite 1500 with AI?

Ready to transform you trading game?

Join thousands of finance professionals who've made the switch to Al-powered stock analysis