Analyze Beta Advantage Research Enhanced US Value data with AI

Sourcetable's AI is the smartest way to analyze market data. Built for Financial Analysts, Traders & Portfolio Managers, it's your AI-native Bloomberg-alternative.

Our Impact

500+

Research Enhanced Value

90%

Time Savings vs Excel

5 Min

Complete Analysis Time

Why Choose Sourcetable for Beta Advantage Research Enhanced US Value Analysis?

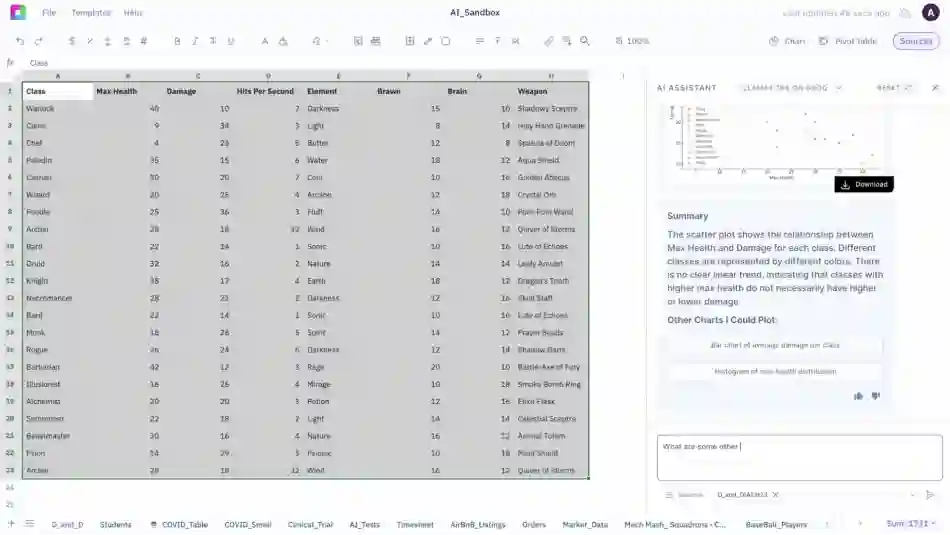

Combine the power of Excel with advanced AI to analyze U.S. stocks like never before

AI-Powered Analysis

Ask questions in plain English: "Which Beta Advantage Research Enhanced US Value stocks show the strongest performance in value characteristics?" Get instant answers with automated calculations and visual insights.

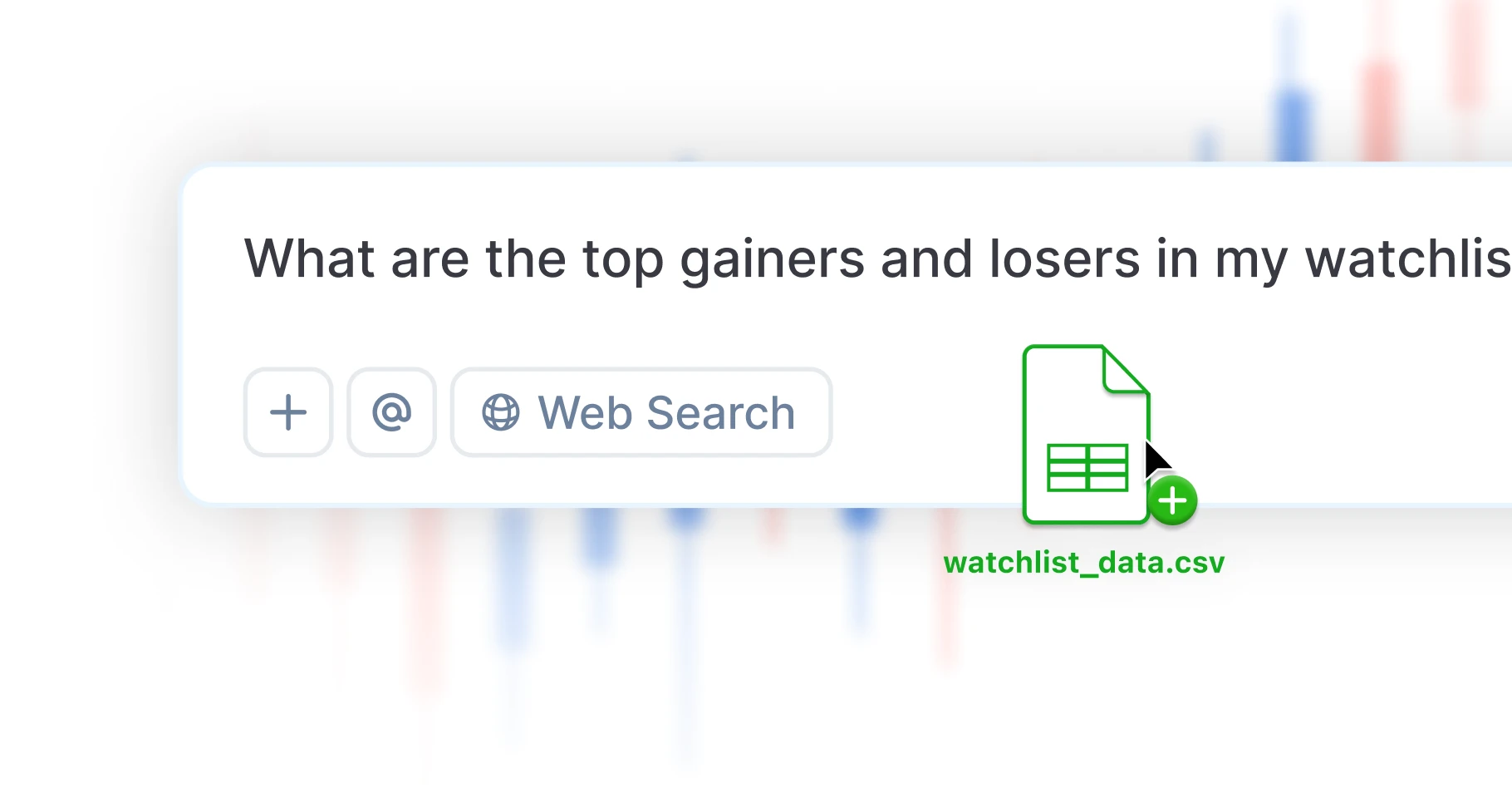

Beta Advantage Research Enhanced US Value Data Analysis

Import and analyze Beta Advantage Research Enhanced US Value data. Track index performance, sector allocations, and value characteristics with comprehensive historical data covering U.S. stocks.

Instant Insights

Generate sector comparisons, risk assessments, and performance rankings in seconds. No more manual data entry or complex formula building.

Advanced Visualizations

Create professional charts, heat maps, and dashboards automatically. Export presentation-ready reports for clients or stakeholders.

Smart Screening

Filter Beta Advantage Research Enhanced US Value constituents by any criteria: market cap, sector allocation, value characteristics, and performance metrics across regional markets.

Risk Analysis

Calculate portfolio risk, correlation matrices, and volatility measures across Beta Advantage Research Enhanced US Value holdings with enterprise-grade accuracy.

Market Analysis Tools

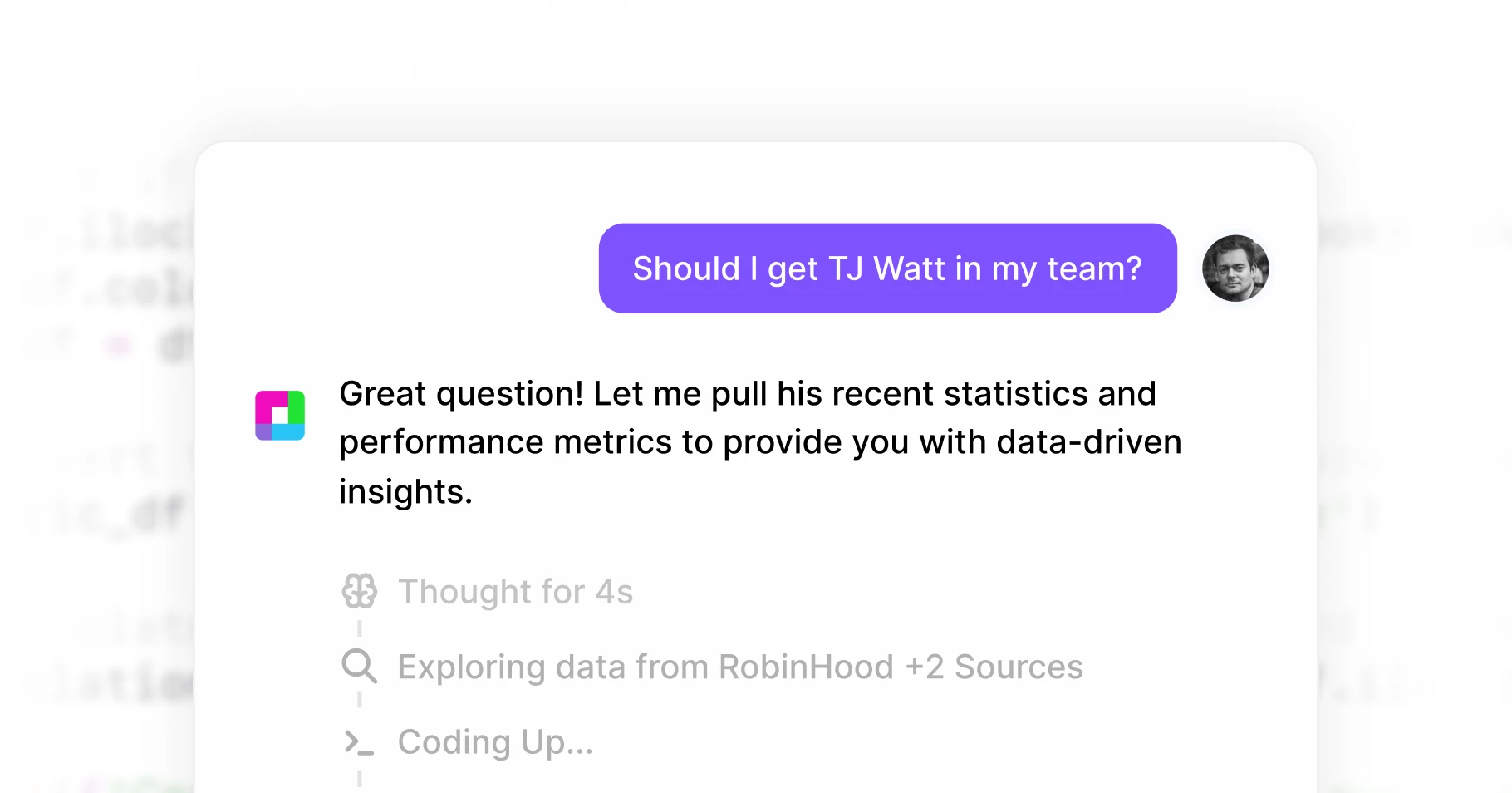

Plan, research, and analyze markets inside Sourcetable with macro trading models, portfolio balancing, and advanced stock analysis. making complex strategies easier to design, test, and compare.

Code with AI

Run advanced financial analysis and research with natural language and Python-powered models.

Stay Connected

Connect brokerages, exchanges, data providers, and databases into one workflow via Superagents.

Execute Trades

Place trades through connected brokerages and platforms, alongside research and modeling.

Ready to transform you trading game?

Join thousands of finance professionals who've made the switch to Al-powered stock analysis