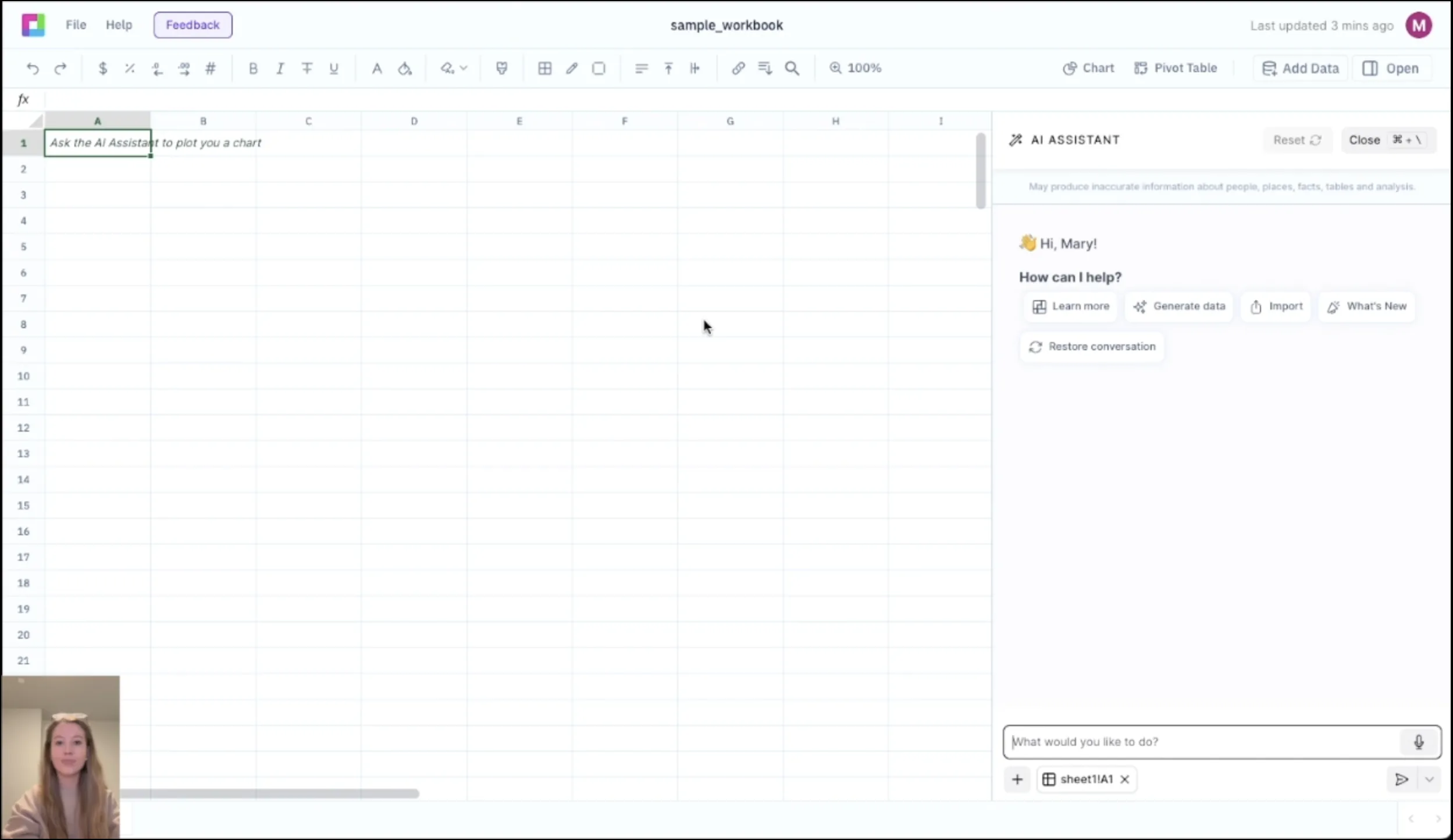

Transform Trading Data Into Profitable Insights

Successful day trading requires more than just making trades—it demands systematic analysis of what works and what doesn't. Our Day Trading Journal Excel template turns your trading activity into a comprehensive performance database, revealing patterns, optimizing strategies, and identifying the setups that generate consistent profits.

Built by traders who understand the importance of data-driven decisions, this template tracks every aspect of your trading: entry/exit times, P&L, emotions, market conditions, and strategy performance. Whether you're a scalper, momentum trader, or swing trader, this journal adapts to your style while providing the analytics needed to improve consistently.

Comprehensive Trade Tracking System

Detailed Trade Log

Record every trade with precise entry/exit times, position sizes, P&L, and commission costs. The template automatically calculates win rates, average gains/losses, and risk-reward ratios. Custom fields allow tracking of setup types, market conditions, and emotional state during each trade.

Real-Time P&L Dashboard

Monitor daily, weekly, and monthly P&L with visual charts showing equity curves and drawdown periods. The dashboard highlights your best and worst trading days, helping identify patterns in performance and emotional decision-making.

Strategy Performance Analysis

Compare performance across different trading strategies, timeframes, and market conditions. The template tracks which setups generate the highest returns and identifies strategies that should be abandoned or refined.

Time-Based Analytics

Analyze performance by hour, day of week, and time of day. Many traders discover they perform better during specific market hours or days, allowing for more focused trading schedules and improved work-life balance.

Advanced Performance Analytics

Statistical Analysis

Calculate professional metrics including Sharpe ratio, maximum drawdown, profit factor, and expectancy. The template compares your performance to market benchmarks and provides context for your trading results.

Risk Assessment

Track position sizing discipline, maximum risk per trade, and correlation between position size and outcomes. Identify if you're risking too much on certain setups or if larger positions generate better returns.

Emotional Trading Tracker

Record emotional state and confidence level for each trade. The template correlates emotions with performance, helping identify when psychological factors impact trading decisions and profitability.

Market Condition Analysis

Track performance across different market conditions including trending, ranging, volatile, and quiet markets. This analysis helps optimize strategy selection based on current market environment.

Frequently Asked Questions

Can I import trades from my broker?

Yes, the template includes instructions for importing trade data from popular brokers including TD Ameritrade, Interactive Brokers, E*TRADE, and others. You can import CSV files or manually enter trades. The template automatically calculates commissions and fees.

How many trades can the template handle?

The template can track thousands of trades without performance issues. It includes summary dashboards that aggregate data efficiently, and you can archive old trades to maintain optimal performance while preserving historical analysis.

Does it work for options and forex trading?

Yes, the template accommodates stocks, options, forex, futures, and crypto trading. Options trades include fields for strike price, expiration, and strategy type. Forex trades include pip calculations and currency pair analysis.

What performance metrics are calculated?

The template calculates over 30 performance metrics including win rate, profit factor, average R-multiple, maximum drawdown, Sharpe ratio, Calmar ratio, and expectancy. All metrics are industry-standard and used by professional traders.

Can I track paper trading?

Absolutely. The template includes a paper trading mode where you can track simulated trades separately from live trading. This helps you test new strategies without risking capital and compare paper vs. live performance.

Related Trading Tools

Frequently Asked Questions

If you question is not covered here, you can contact our team.

Contact Us