Professional Options Trading Analysis Made Simple

Options trading requires precise calculations and risk management. Our Options Strategy Analyzer Excel template transforms complex derivatives mathematics into an intuitive tool that calculates Greeks, models profit/loss scenarios, and helps you visualize strategy outcomes before placing trades.

Whether you're selling covered calls for income, constructing iron condors for range-bound markets, or implementing complex multi-leg strategies, this template provides the analytical power you need. Built by traders for traders, it includes real-time Greeks calculations, breakeven analysis, and comprehensive strategy comparison tools.

What Is an Options Strategy Analyzer?

An Options Strategy Analyzer is a sophisticated Excel tool that calculates option prices, Greeks (Delta, Gamma, Theta, Vega, Rho), and profit/loss scenarios for various options strategies. It helps traders evaluate potential trades, understand risk exposure, and optimize position sizing before entering the market.

Key Features and Calculations

The template includes Black-Scholes pricing models, implied volatility calculations, and Greeks analysis. It supports single options, spreads, straddles, strangles, iron condors, butterflies, and custom multi-leg strategies. Real-time profit/loss graphs show potential outcomes at different underlying prices and times to expiration.

Advanced features include volatility smile modeling, probability of profit calculations, expected value analysis, and position Greeks aggregation. The template automatically calculates margin requirements and helps optimize strike selection based on your market outlook and risk tolerance.

Getting Started with Options Analysis

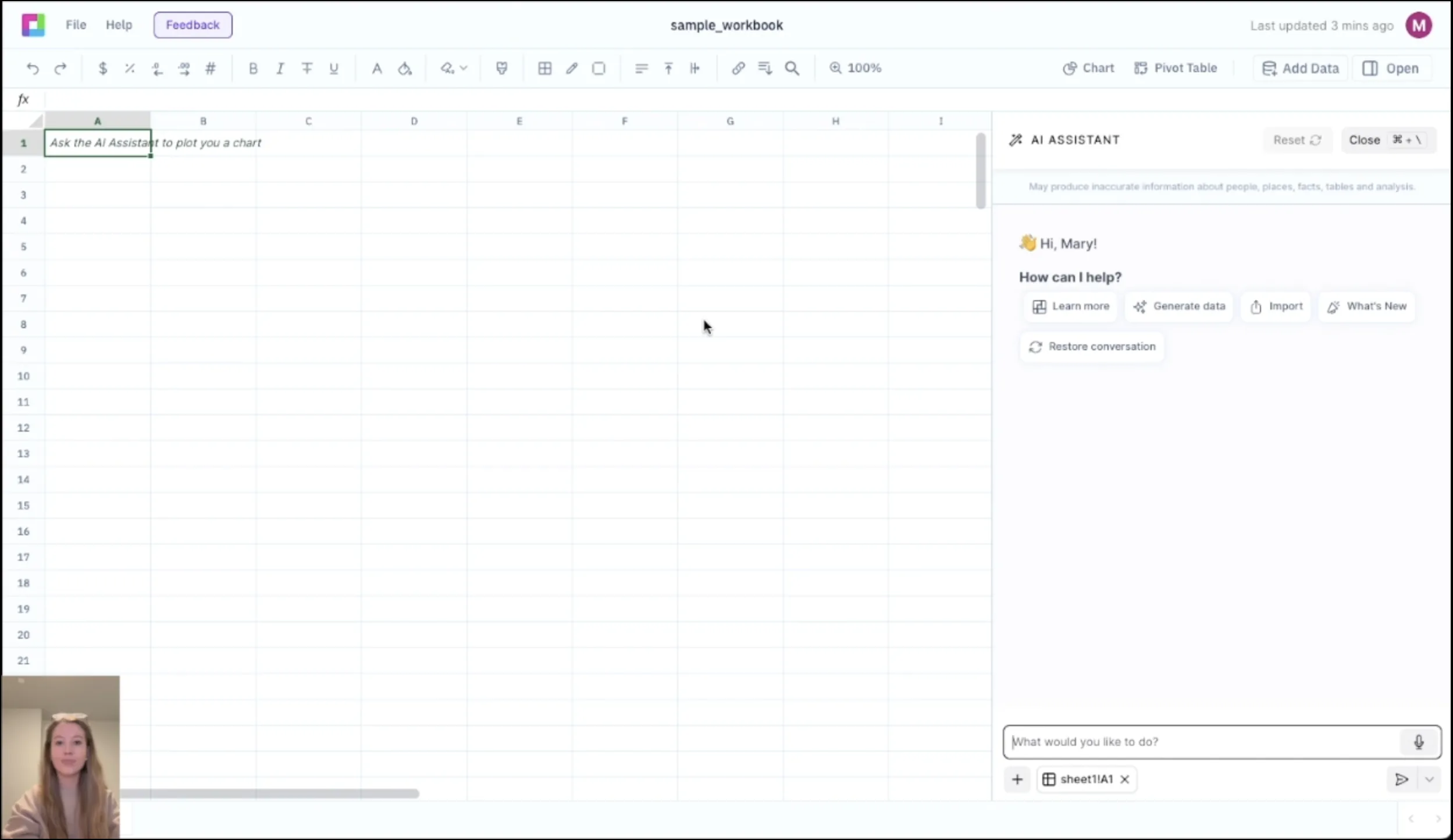

Step 1: Input Current Market Data

Enter the current stock price, implied volatility, risk-free rate, and dividend yield. The template automatically updates all calculations based on these inputs. You can also import live data feeds for real-time analysis.

Step 2: Define Your Strategy

Select your options strategy from the dropdown menu or build a custom strategy by entering individual option legs. Specify strike prices, expiration dates, and position sizes. The template supports up to 8 legs for complex strategies.

Step 3: Analyze Results

Review the automatically generated profit/loss diagram, Greeks summary, and probability analysis. The template shows maximum profit, maximum loss, breakeven points, and probability of profit. Use the scenario analysis tools to stress-test your strategy under different market conditions.

Frequently Asked Questions

What options strategies does this template support?

The template supports all major options strategies including calls, puts, covered calls, protective puts, spreads (vertical, horizontal, diagonal), straddles, strangles, iron condors, butterflies, and custom multi-leg strategies. You can analyze up to 8 option legs simultaneously.

How are the Greeks calculated?

The template uses the Black-Scholes model to calculate Delta, Gamma, Theta, Vega, and Rho. For American options, it includes early exercise considerations. All Greeks are calculated in real-time as you adjust inputs, showing both individual leg Greeks and position-level Greeks.

Can I import real-time market data?

Yes, the template includes connections for importing live stock prices, option chains, and implied volatility data. You can also manually input data or paste from your broker's platform. The template updates all calculations automatically when new data is entered.

Does it include probability analysis?

Yes, the template calculates probability of profit, probability of maximum profit, and expected value for each strategy. It uses Monte Carlo simulations and statistical models to provide probability distributions and confidence intervals for your trades.

How does the profit/loss visualization work?

The template generates interactive P/L diagrams showing profit/loss at expiration and at various dates before expiration. You can adjust the underlying price range, add probability overlays, and compare multiple strategies on the same chart.

Related Excel Templates

Frequently Asked Questions

If you question is not covered here, you can contact our team.

Contact Us