Build Sustainable Passive Income Through Dividends

For income investors, tracking dividend payments across a growing portfolio can quickly become overwhelming. Our Dividend Income Tracker Excel template simplifies portfolio management by automatically calculating yields, tracking payment schedules, and projecting future income streams based on historical growth rates.

Whether you're building a retirement income portfolio, implementing a dividend growth strategy, or maximizing yield on cost through DRIP programs, this template provides the insights you need to make informed investment decisions and track your progress toward financial independence.

Comprehensive Dividend Tracking Features

Yield Analysis Dashboard

Monitor current yield, yield on cost, and forward yield for your entire portfolio. The template automatically calculates weighted average yields and compares them to market benchmarks. Track how your income stream grows relative to your initial investment.

Payment Schedule Calendar

Never miss a dividend payment with our automated calendar that tracks ex-dividend dates, record dates, and payment dates. The visual calendar shows expected monthly income and highlights companies with upcoming dividend announcements.

DRIP Calculator

Model the power of dividend reinvestment with our DRIP calculator. See how reinvesting dividends accelerates portfolio growth through compounding. Compare scenarios with and without DRIP to understand the long-term impact on your wealth.

Dividend Growth Analysis

Track dividend growth rates over 1, 3, 5, and 10-year periods. Identify dividend champions, contenders, and challengers. The template calculates compound annual growth rates and projects future dividend income based on historical trends.

Project Your Future Income Stream

Our advanced projection tools help you plan for retirement or financial independence. Input your target income goal and see how long it will take to achieve based on current savings rate, dividend yields, and growth assumptions.

Scenario Planning

Model different market scenarios including dividend cuts, growth acceleration, and portfolio rebalancing. The template shows how various scenarios impact your income timeline and helps you prepare for market volatility.

Tax Optimization

Track qualified vs. ordinary dividends for tax planning. The template calculates after-tax income based on your tax bracket and helps optimize asset location between taxable and tax-advantaged accounts.

Frequently Asked Questions

How many stocks can the template track?

The template can track up to 100 dividend-paying stocks simultaneously. It automatically aggregates data across all holdings to show portfolio-level metrics including total income, average yield, and sector allocation.

Does it handle international dividends?

Yes, the template supports multiple currencies and automatically handles currency conversion for international dividends. It also tracks withholding taxes and ADR fees for accurate net income calculations.

Can I track monthly dividend payers?

Absolutely. The template accommodates monthly, quarterly, semi-annual, and annual dividend payers. It automatically adjusts calculations based on payment frequency and provides accurate monthly and annual income projections.

How does the DRIP calculator work?

Input your DRIP enrollment status for each holding, and the template automatically calculates share accumulation through dividend reinvestment. It shows the compound effect over time and compares your portfolio growth with and without DRIP.

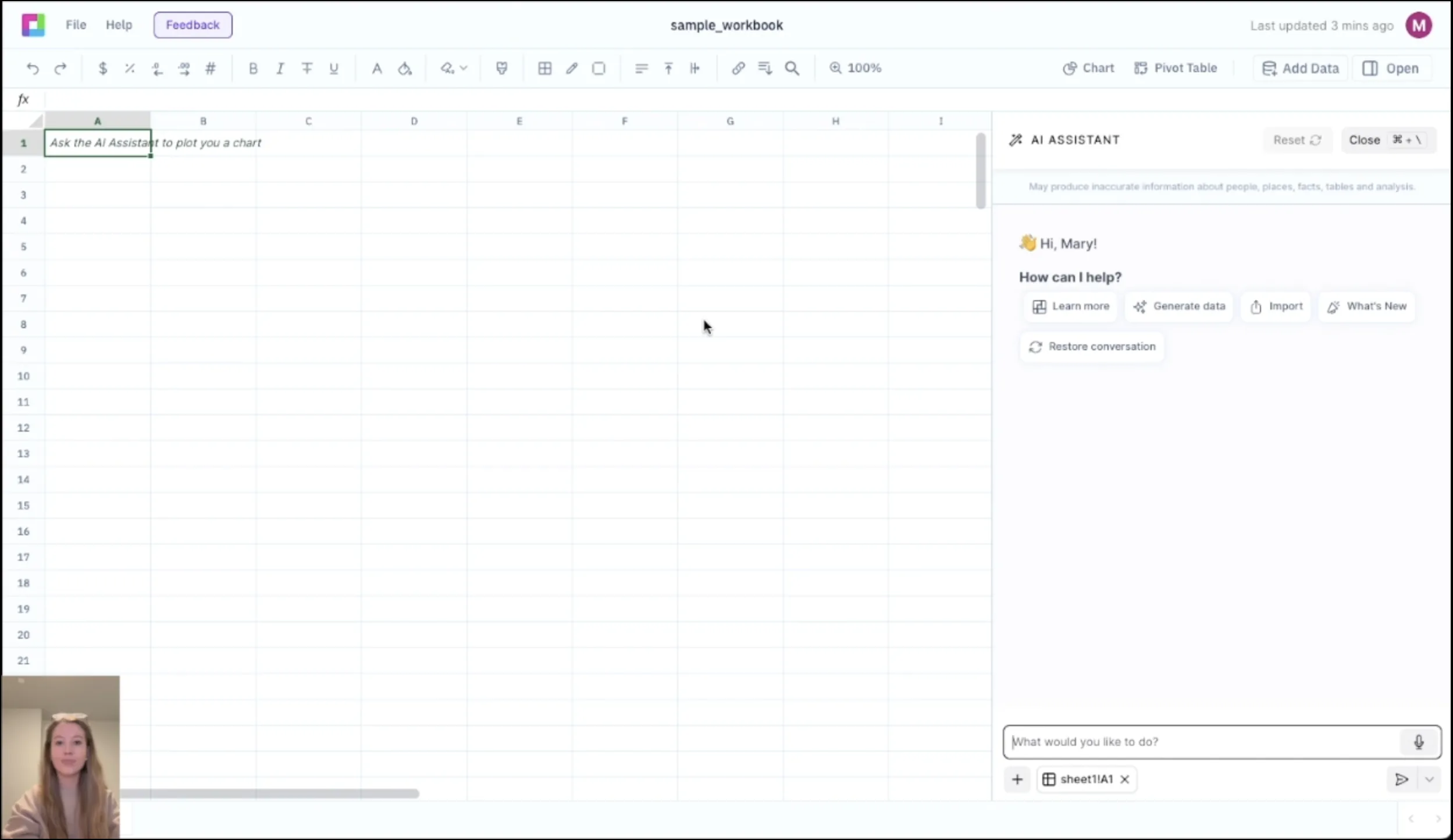

Can I import dividend data automatically?

The template includes instructions for importing dividend data from major brokers and financial websites. You can also manually input data or use our CSV import feature for bulk updates.

Related Investment Templates

Frequently Asked Questions

If you question is not covered here, you can contact our team.

Contact Us