Generate Any Excel Formula With AI

Use Sourcetable's AI assistant to create and understand complex Excel formulas. No advanced Excel skills required. Sign up to get started for free.

Trusted by students and professors at

Excel Formulas Made Easy With AI

Sourcetable leverages ChatGPT's powerful AI to help you create, understand, and optimize Excel formulas with ease.

Natural Language Formula Creation

Describe what you want to achieve in plain English, and AI will generate the appropriate Excel formula for you.

Try for free

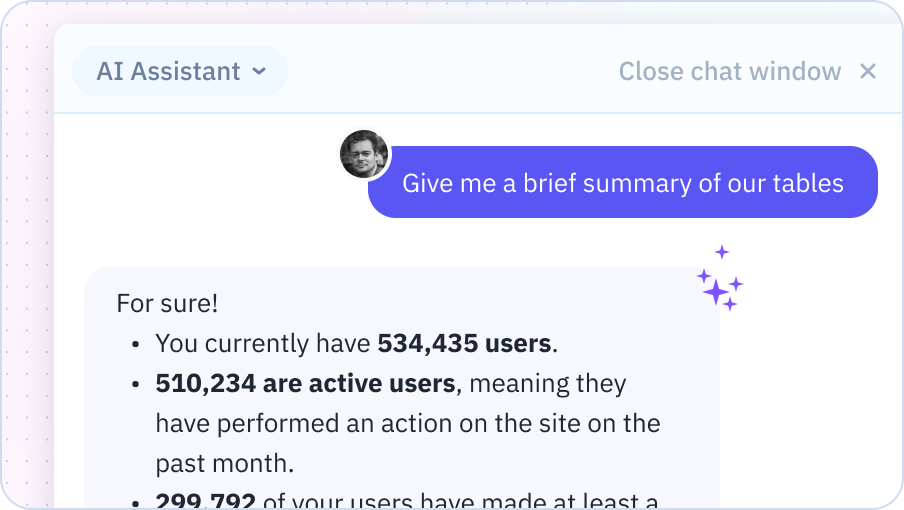

Formula Explanation

Get clear, step-by-step explanations of complex formulas, helping you understand and modify them with confidence.

Try for free

Formula Optimization

AI analyzes your formulas and suggests optimizations for better performance and readability.

Try for free

Error Detection and Correction

AI identifies errors in your formulas and provides suggestions to fix them, saving you time and frustration.

Try for free

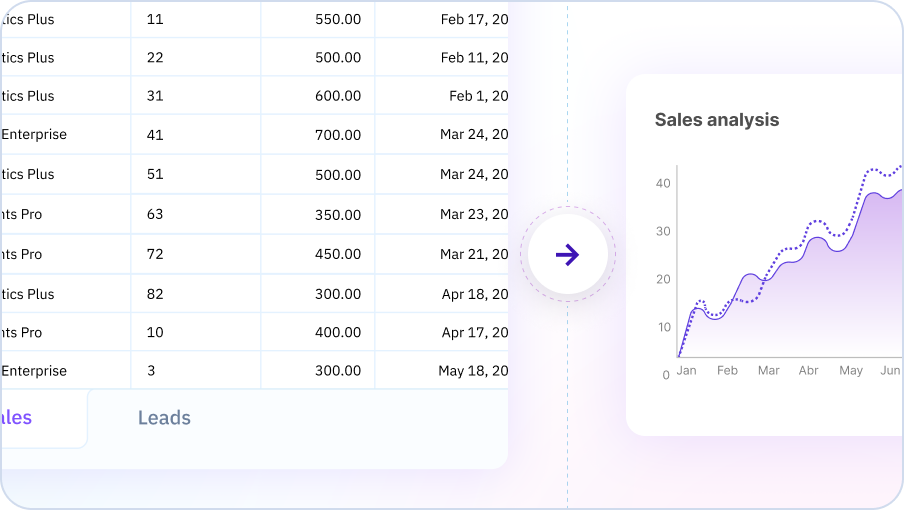

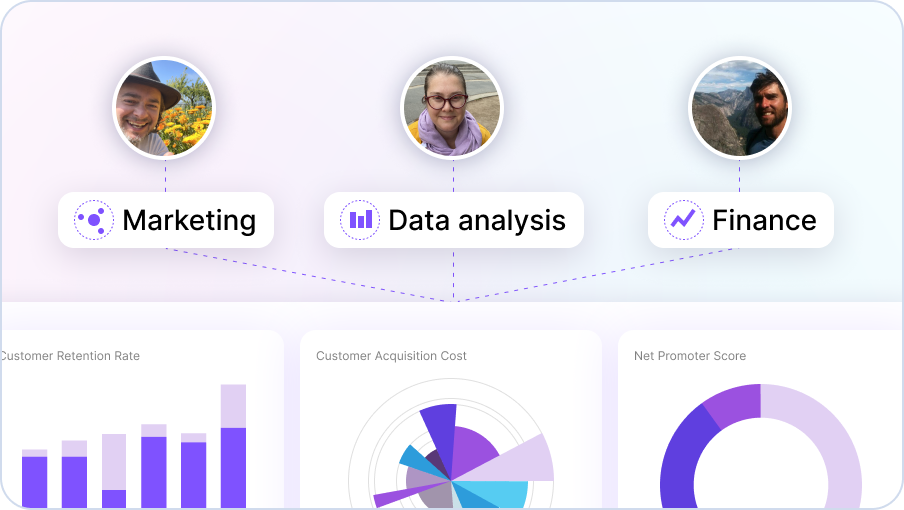

AI tools to make you work smarter

Create spreadsheets from scratch. Generate and analyze your data. All with AI.

Sign Up For Free

Start creating powerful Excel formulas with AI. Sign up for Sourcetable today.

Team Purple

See what people are saying about Sourcetable's AI Excel Formula Assistant

Chris Aubuchon

@ChrisAubuchon

Spreadsheets are still the best interface for so many real world projects, it's time for @SourcetableApp to give them a reboot

Micah Alpern

@malpern

Love seeing innovation in this space after so many decades with very little.