Master Portfolio Risk with Professional-Grade Tools

Every successful trader knows that protecting capital is the first rule of the game. Our comprehensive risk management calculator transforms complex financial calculations into actionable insights, helping you make informed decisions that preserve wealth while maximizing risk-adjusted returns.

From position sizing to Value at Risk calculations, this template provides the analytical framework that professional fund managers rely on daily. Whether you're managing a personal portfolio or overseeing institutional investments, having robust risk controls isn't just smart—it's essential.

Professional risk management isn't about limiting profits—it's about ensuring you stay in the game long enough to achieve them.

Capital Preservation

Protect your trading capital with scientifically-backed position sizing formulas and stop-loss optimization strategies that minimize drawdowns.

Value at Risk (VaR) Analysis

Calculate potential losses with statistical confidence intervals, giving you clear insight into your portfolio's risk exposure over different time horizons.

Beta Coefficient Tracking

Measure how your positions move relative to market benchmarks, helping you understand correlation risks and diversification benefits.

Position Sizing Optimization

Use Kelly Criterion and other proven formulas to determine optimal position sizes that maximize long-term growth while controlling risk.

Stop-Loss Automation

Calculate ideal stop-loss levels based on volatility, support/resistance levels, and risk tolerance to protect against adverse moves.

Risk-Adjusted Returns

Track Sharpe ratios, Sortino ratios, and other key metrics that show whether your returns justify the risks you're taking.

Checkout what Sourcetable has to offer

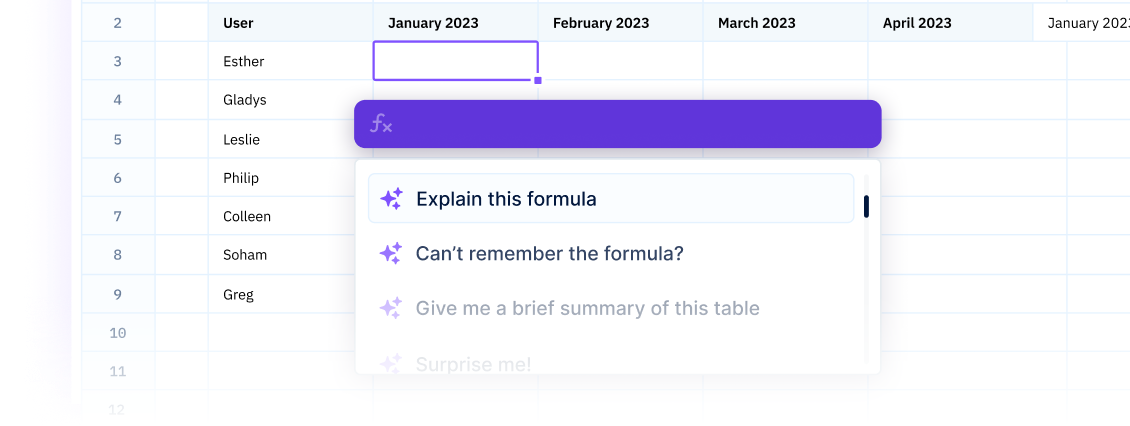

Position Sizing Calculator

Kelly Criterion, fixed fractional, and volatility-based position sizing formulas with customizable risk parameters.

Value at Risk (VaR) Engine

Historical simulation, parametric, and Monte Carlo VaR calculations with confidence intervals from 90% to 99%.

Beta Analysis Dashboard

Real-time beta coefficients, correlation matrices, and market exposure analytics for comprehensive risk assessment.

Stop-Loss Optimizer

Volatility-based, technical level, and percentage-based stop-loss calculations with risk-reward optimization.

Risk-Adjusted Performance

Sharpe ratio, Sortino ratio, maximum drawdown, and other key metrics for evaluating risk-adjusted returns.

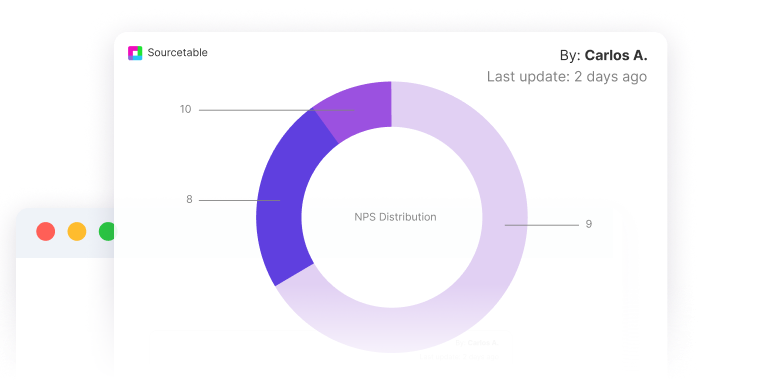

Portfolio Heat Map

Visual risk concentration analysis showing sector exposure, position sizes, and correlation risks across holdings.

Enhance Your Risk Management Strategy

Frequently Asked Questions

If you question is not covered here, you can contact our team.

Contact Us