Navigate Earnings Season Like a Pro

Earnings reports drive stock prices, create volatility, and reveal company fundamentals. Our Earnings Analysis Tracker transforms quarterly chaos into organized insights, helping you spot trends, identify surprises, and make informed decisions before and after earnings announcements.

Built for investors who understand that consistent earnings growth drives long-term returns, this template provides the analytical framework to track performance across multiple companies, compare results to estimates, and identify quality growth stories hidden in the numbers.

Comprehensive Earnings Tracking System

Earnings Calendar Dashboard

Track upcoming earnings dates for your entire portfolio with automated alerts and pre-earnings checklists. The visual calendar highlights reporting dates, consensus estimates, and historical surprise patterns to help you prepare for each announcement.

EPS Growth Analysis

Monitor earnings per share growth over multiple quarters and years. The template calculates year-over-year growth rates, sequential growth, and compound annual growth rates (CAGR). Visualize EPS trends with automated charts that highlight acceleration or deceleration patterns.

Revenue & Margin Tracking

Beyond EPS, track revenue growth, gross margins, operating margins, and net margins. The template identifies margin expansion or compression trends that signal improving or deteriorating business fundamentals.

Earnings Surprise History

Document actual vs. estimated earnings for each quarter, calculating surprise percentages and tracking patterns. Companies with consistent positive surprises often outperform, and our template helps identify these quality performers.

Advanced Earnings Analysis Tools

Guidance Tracking

Monitor management guidance changes and track performance against forward-looking statements. The template compares actual results to both analyst estimates and company guidance, revealing management credibility and conservatism.

Peer Comparison

Compare earnings performance across industry peers to identify market share gainers and best-in-class operators. Relative performance analysis helps separate company-specific strength from industry trends.

Quality Metrics

Calculate earnings quality scores using metrics like accruals ratio, cash conversion, and one-time item adjustments. High-quality earnings are more likely to persist and support higher valuations.

Frequently Asked Questions

How many companies can I track?

The template accommodates up to 50 companies with full earnings history and analysis. You can track entire portfolios, watchlists, or sector groups. The dashboard automatically aggregates metrics to show portfolio-level earnings trends.

Where do I get earnings data?

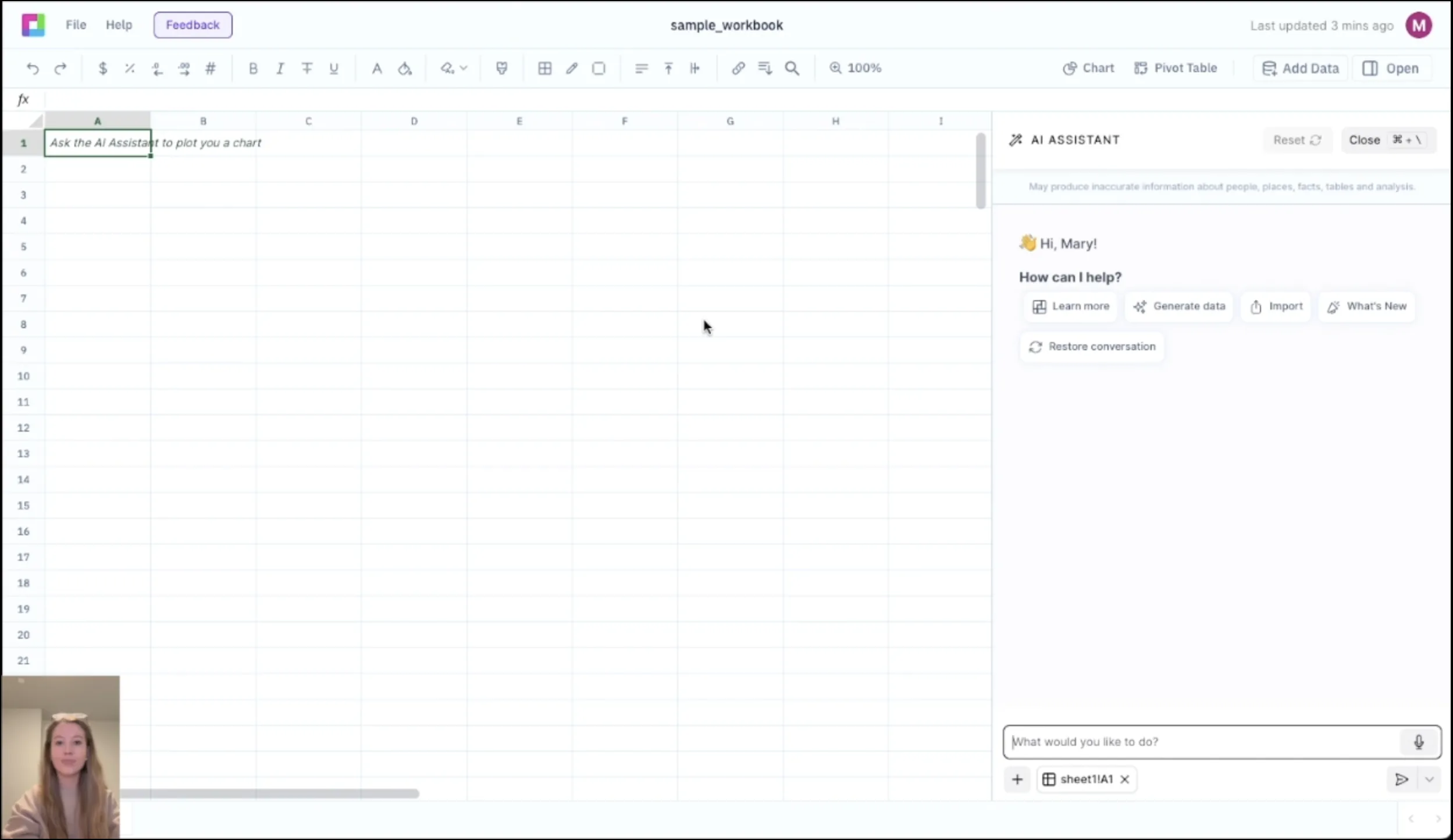

We provide instructions for importing data from financial websites, company investor relations pages, and broker platforms. The template includes links to free data sources and can import CSV files from most financial data providers.

Can I track pre-announcements and revisions?

Yes, the template includes sections for tracking earnings pre-announcements, estimate revisions, and guidance updates between quarters. This helps you stay ahead of official announcements and understand evolving expectations.

Does it calculate forward P/E ratios?

Yes, the template calculates trailing and forward P/E ratios based on your earnings estimates. It also tracks PEG ratios, earnings yield, and shows how valuations change with earnings revisions.

Can I analyze earnings by segment?

The template includes tabs for segment analysis where you can break down revenue and earnings by business unit, geography, or product line. This granular analysis helps identify growth drivers and problem areas.

Related Analysis Templates

Frequently Asked Questions

If you question is not covered here, you can contact our team.

Contact Us